One of the best ways to do that is to position the bank as the customer’s financial home page by giving them all of the tools they need to manage their finances in one place. Nicole Sturgill, Research Director at TowerGroup, a Corporate Executive Board company states, “As consumers continue to bank more often outside the branch, it is important that banks look for ways to build customer relationships through electronic channels. The new version of Finacle e-banking provides unique personalization capabilities, industry-leading security features and intelligent customer insights to drive adoption of online banking channel and enhance customer loyalty. The solution is a comprehensive offering that empowers banks to achieve quick global rollouts of online banking services.

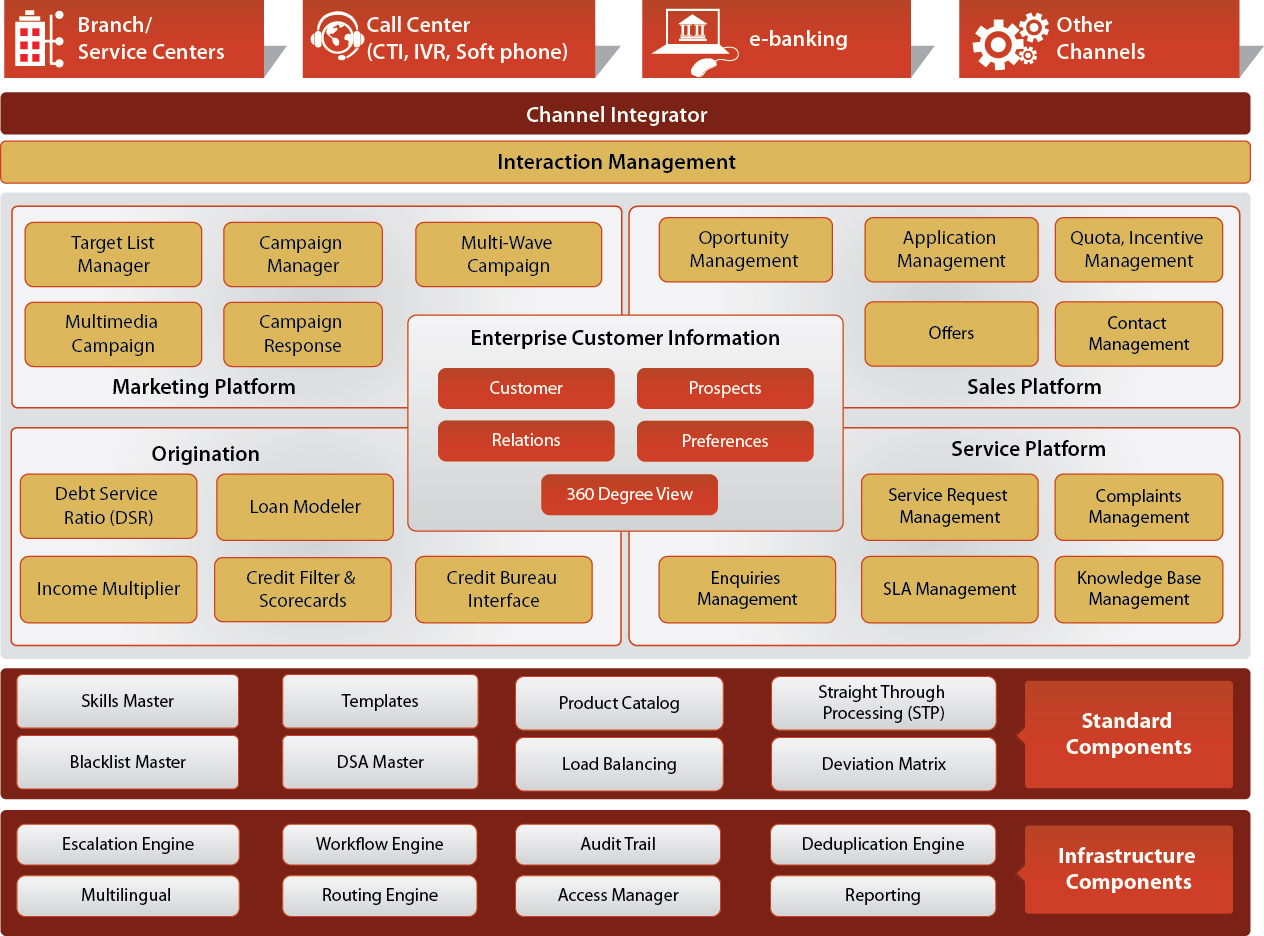

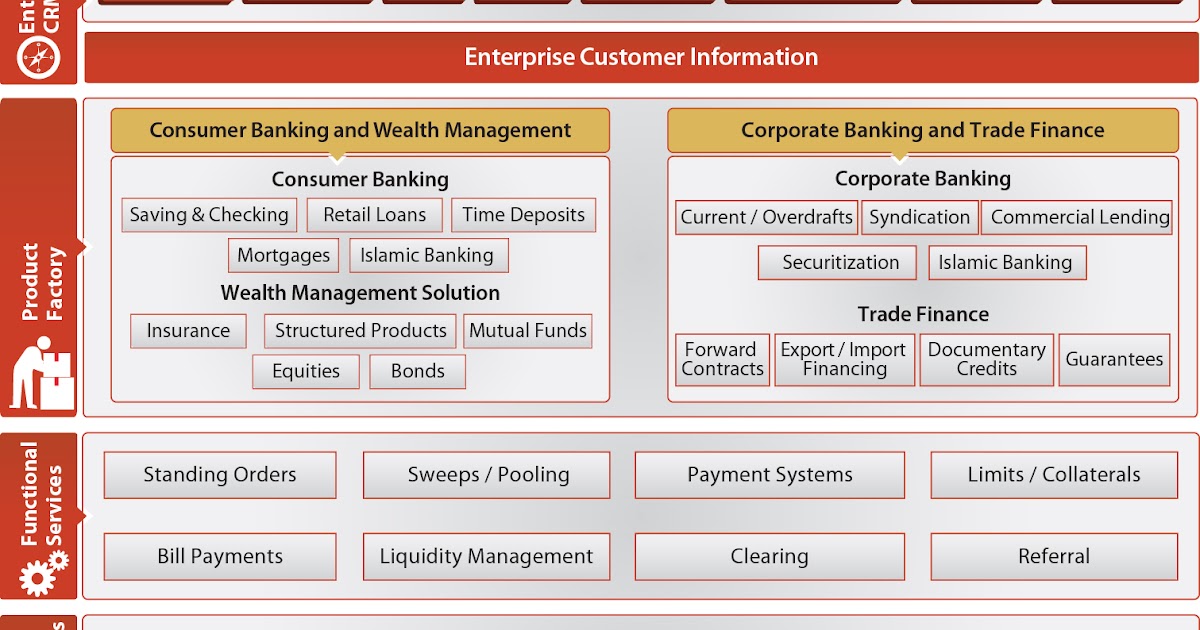

Offers and catalog – Empowers banks to publish instant offers across channels.Persona Driven User Experiences and Analytics Promise to Redefine Online Banking Engagementsīangalore, London October 14, 2011: Infosys, a global leader in consulting and technology, today announced the launch of Finacle e-Banking Version 11 at the 2011 BAI Retail Delivery Show in Chicago.Multichannel framework – Enables customers to navigate seamlessly across multiple channels without losing the transaction context.Payments – An ISO 20022 based advanced payment services hub to future-proof banks’ payments business.With this release, Finacle has added six new enterprise components to its suite:.This in turn helps banks reduce their cost of operations and simplify their processes. Helping banks break their technology silos and eliminate duplicate applications.The product factory capabilities in Finacle 11E empower banks to create and deploy new products in weeks instead of months.Ensuring shorter deployment cycles and significantly lower total projects with its ready made integration adaptors and compliance to industry standards.Making it easy for banks to quickly target new customer segments and modernize their business, by choosing the components they need and replacing their existing systems one step at a time.Its enterprise-class components are built to enhance the efficiency of a bank's operations, while improving customer experience across all channels.Īs banks aim to reinvent their business and navigate the current challenges in the macroeconomic environment, Finacle 11E promises a simplified approach to banking transformation by:

The solution makes possible the faster launch of new products and services, helping banks realize a 55 percent return on core banking transformation investments* and an average improvement of 33 percent in their time to market**.įinacle 11E’s componentized approach helps banks of all sizes rapidly modernize their operations in a phased manner, while minimizing risk. Finacle 11E, the newest release of the Finacle universal banking solution builds on the success of Finacle to deliver powerful benefits to global banks.

0 kommentar(er)

0 kommentar(er)